In the wake of a series of global health, geopolitical, and economic crises that have left many construction markets currently experiencing flat or declining volumes, contractors want to know what the years ahead will bring.

The good news is that Global Construction Futures, a major study of the global construction and engineering industry published by the team of construction economists at Oxford Economics, shows that the future is bright. Global construction work done will grow over US$4.2 trillion over the next 15 years – from US$9.7 trillion in 2022 to US$13.9 trillion by 2037.

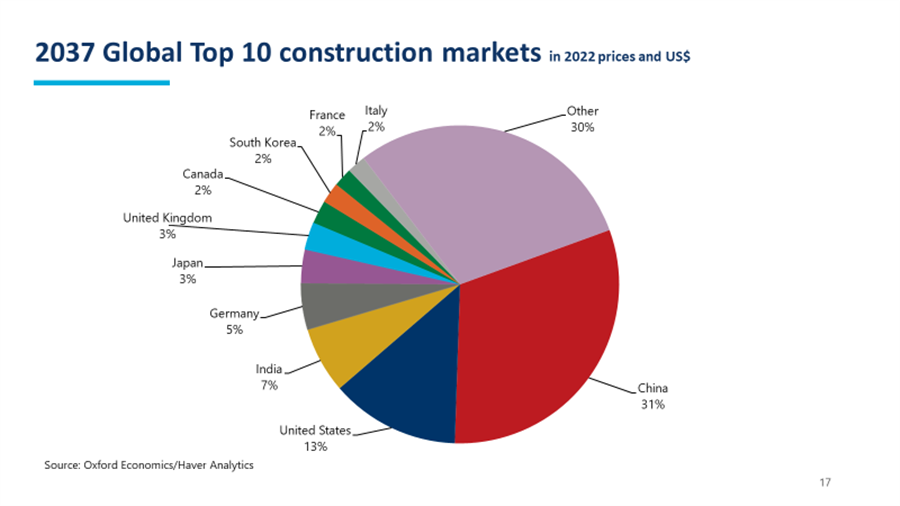

China, the US, and India will account for half of all work done in the global construction and engineering market by 2037 – underpinning the future economic development of the three countries that account for over a third of the world’s population and economic output.

Top ten markets to account for 70% of all construction output

The top ten global construction markets will account for 70% of all construction work done by 2037 and represent a market worth over US$9.7 trillion in 2037, approximately the same size as all global construction work done today.

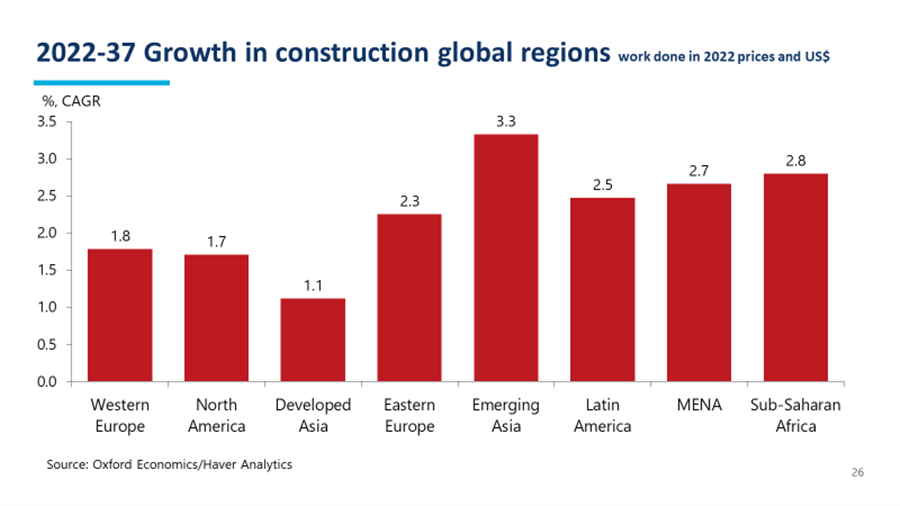

The ASEAN tiger economies (Hong Kong, Singapore, South Korea, and Taiwan) as well as India and Bangladesh will deliver super-high growth over the period to 2037. We expect growth over the next 15 years in India alone to be higher than the US, as the world’s most populous country becomes a near US$1 trillion global construction powerhouse.

Growth in construction work done in China will likely slow over the next 15 years as its population starts to fall. A significant ageing profile will mean a greater dependency on fewer workers and savings to support later living. Even given these negative drivers we still expect growth in residential construction work done to exceed US$500 billion over the next 15-year period.

The next five years will be buoyed by large infrastructure programmes designed to push the region to net zero carbon emissions. Funds from the €800 billion (US$863 billion) EU Next Generation fund have already begun flowing, with Spain and Italy key beneficiaries.

The EU Renovation Wave is a second important programme that will impact construction activity, as it aims to double the renovation rate of both residential and non-residential buildings with a target of reducing their greenhouse gas emissions 60% by 2030.

The past ten years have been a lost decade of construction for Eastern Europe, with the volume of work done in 2022 no greater than it was in 2012. But the push for more nearshoring amid geopolitical uncertainties and pandemic-fuelled trends toward more supply chain resilience have already started to revive its fortunes. We expect the Eastern European construction market to grow more than US$180 billion (US$194 billion) by 2037, a 40% increase from 2022.

External financial support will remain crucial for preserving a fragile macroeconomic stability in Ukraine. We are encouraged by joint efforts by the US, the EU, and the rest of the G7 to provide a regular inflow of around US$3 billion per month – Which is the minimum Ukraine needs to finance its fiscal deficit. The new IMF programme will further boost recovery.

Taken together, the global construction industry is on the cusp of an exciting change. The opportunity in the construction sector is simply enormous.